Upcoming ASX reporting season - opportunities & risks?

- Royce Advisory

- Jul 29, 2024

- 4 min read

As the curtain rises on the Australian equity 2024 full year reporting season, investors are poised & anticipating a performance that could shape market sentiment for the remainder of the year. With global economic uncertainties looming and domestic challenges persisting, this earnings season promises to be of great important to investor portfolios

Where are we screening for Earnings Risks?

High Second-Half Earnings Skew: Identify stocks with a high reliance on second-half earnings. Potential risks include RHC, RWC, DHG, and MPL. Conversely, Goodman Group (GMG) might be a potential beat given its lower skew.

Optimistic Margin Forecasts: Be cautious of stocks with overly optimistic margin expansion forecasts. SEK, IRE, HLS, DMP, and DOW fall into this category.

Consensus Revisions: Monitor stocks with significant net EPS downgrades, which are more likely to miss earnings expectations. SHL, SEK, RHC, IEL, DMP, DOW, and NHF are notable risks, while ALL, SDF, PME, ALQ, and REA have shown positive revisions.

What are some Counter Consensus Calls?

Positive Views: Stocks like Computershare (CPU), Origin Energy (ORG), and Pro Medicus (PME) have been upgraded and may continue to perform well.

Negative Views: Stocks such as Star Entertainment (SGR), Healius (HLS), AMP, SEK, SHL, DMP, and APE have seen downgrades and may underperform.

Earnings Expectations vs. Reality

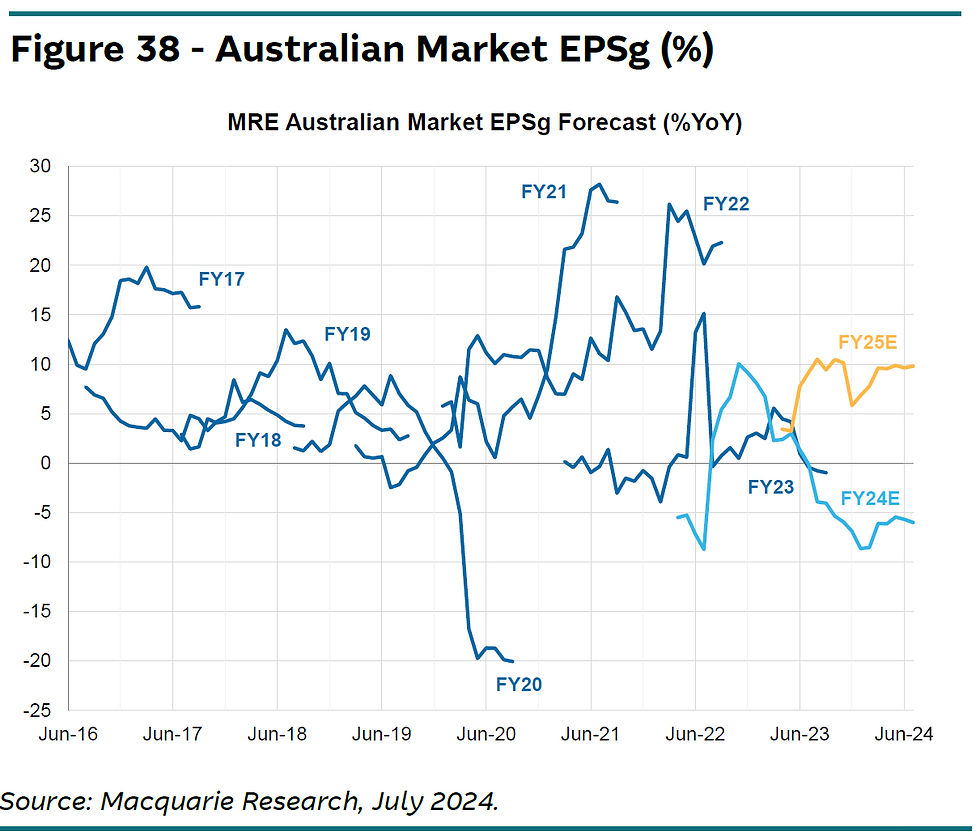

Consensus forecasts suggest a 6% decline in ASX earnings for FY24, followed by a 10% rebound in FY25. However, history tells us that initial forecasts tend to be optimistic. The median earnings realisation ratio over the past two decades suggests that FY25 earnings may need a 4% haircut from current projections. Investors should brace for potential disappointments and adjust their portfolios accordingly.

Australian Market EPSg Forecast shows the historical and projected Earnings Per Share growth for the Australian market. This chart illustrates the expected earnings trajectory, highlighting the anticipated rebound in FY25 after a challenging FY24.

Sector Disparities

Expected divergence between sectors highlights the importance of sector allocation in portfolio construction.

Resources: This sector is expected to be a significant driver of the earnings rebound in FY25. However, FY24 has been tough due to lower commodity prices and higher costs. Investors should watch for updates on commodity price trends and cost management strategies from major resource companies.

Industrials: This sector shows positive earnings growth, particularly for companies with international exposure, benefiting from stronger productivity growth in the US. Key contributors include CSL, Aristocrat, and Origin Energy.

Banks: Earnings are forecasted to decline slightly in FY24 and FY25, impacted by expected interest rate cuts by the Reserve Bank of Australia (RBA).

Margin Pressure and Cost Management

With inflationary pressures persisting, companies' ability to manage costs and maintain margins will be crucial. Keep an eye on firms with high labor costs or those struggling to pass on price increases to consumers. Sectors like healthcare and consumer discretionary may face particular scrutiny.

Guidance and Outlook Statements

Given the uncertain economic environment, forward-looking statements from management will be as important as the reported numbers. Pay close attention to companies' guidance for the coming year and any changes in their outlook. This could provide valuable insights for adjusting your investment strategy.

Global Economic Factors

While focusing on Australian companies, it's essential to consider the global context. Issues such as US interest rate expectations, China's economic recovery, and geopolitical tensions can significantly impact Australian equities, especially those with international exposure.

Dividend Policies

In a low-growth environment, dividends become increasingly important for total returns. Watch for any changes in dividend policies or payout ratios, which could signal management's confidence (or lack thereof) in future earnings.

Capital Allocation

Decisions How companies choose to allocate capital in the current environment can provide insights into their long-term strategy and confidence. Look for announcements on share buybacks, capital expenditures, or M&A activities.

Small Cap Opportunities

While large caps often dominate headlines, don't overlook potential opportunities in the small cap space. Small industrials are forecasted to see 13% earnings growth in FY25, potentially offering attractive investment prospects for those willing to take on additional risk.

Where to from here

As we navigate through this reporting season, it's clear that opportunities and risks abound in the Australian equity market. The divergence between sectors, the potential for earnings disappointments, and the importance of forward guidance all underscore the need for active management and careful stock selection.

For investors, this environment calls for a balanced approach. Consider diversifying across sectors to mitigate risks, focus on companies with strong cost management and pricing power, and be prepared to adjust your portfolio based on the evolving earnings landscape.

Remember, in times of uncertainty, quality often prevails. Look for companies with robust balance sheets, sustainable competitive advantages, and management teams with a track record of delivering through various economic cycles.

Royce Advisory Pty Ltd (ABN 43 622 402 706) is a Corporate Authorised Representative (CAR) of MB Capital Partners Pty Ltd (AFSL 536053). This article, commentary and discussion is general information only and is not intended to provide you with financial advice as it does not consider your investment objectives, financial situation or particular needs. You should consider whether the information is suitable for your circumstances and where uncertain seek further professional advice.

This communication is based on information from sources believed to be reliable at the time of its preparation (July 2024). However, despite our best efforts, no guarantee can be given that all information is accurate, reliable and complete. Any opinions expressed in this email are subject to change without notice and neither Royce Advisory or MB Capital Partners is not under any obligation to notify you with changes or updates to these opinions. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information.

Comments