How would a Trump presidency impact US-China relations & markets?

- Royce Advisory

- Aug 15, 2024

- 1 min read

The US presidential election is less than four months away. The election outcomes will be consequential to asset markets globally, US-China relations, and China equity returns.

Some macro themes that are sensitive to market perceived US policy risks are US vs non-US exporters, RMB depreciation winners vs losers, and the SOE-POE divide in the run-up to the event.

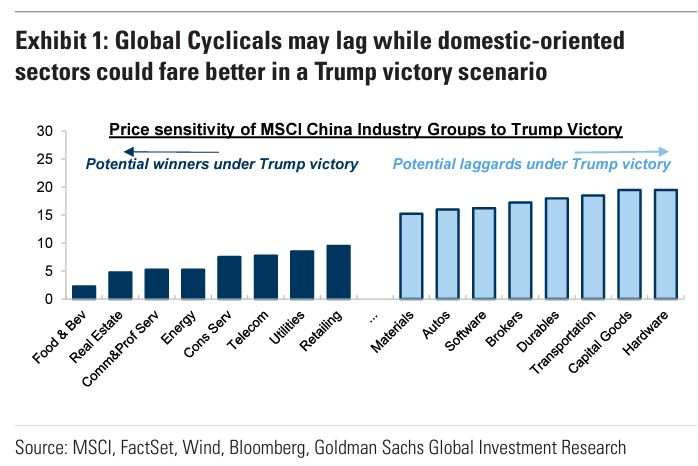

A recently published Goldman Sachs framework ranked sector sensitivity to key US-election-focused variables outlining that domestically-linked sectors such as F&B, Consumer Services, Consumer Tech (Media/Retailing) appear better-placed if Trump regains presidency, whereas Global Cyclicals, particularly Tech Hardware, Cap Goods, Durables, and Transportation may lag.

Comments