Digital Transformation Investment Opportunities

- Royce Advisory

- Aug 16, 2024

- 4 min read

Digital transformation is reshaping the global economy, offering compelling investment opportunities, especially in the realm of digital technologies. The digital transformation is not just a buzzword; it's a seismic shift that's creating winners and losers across every sector.

As we navigate 2024 with our investors, understanding these opportunities is crucial to correctly optimize portfolios and asset allocation.

The Expanding Digital Economy

The digital economy is growing at a breakneck pace, far outstripping traditional sectors. According to the Bureau of Economic Analysis (BEA), the U.S. digital economy expanded by over 7% annually between 2017 and 2022, compared to just 2.2% for the overall economy.

This growth is not just confined to the U.S. Across 27 major economies, the IT sector has grown nearly three times faster than the overall economy in recent years. This trend shows no signs of slowing, with estimates suggesting the digital economy could represent over 20% of global GDP in the coming years.

Investment Implication: Look for companies that are at the forefront of digital transformation, not just in the tech sector, but across all industries. Firms that successfully integrate digital technologies into their core business models are likely to outperform their peers.

The AI Revolution

Artificial Intelligence (AI) is perhaps the most transformative force within the digital economy. The International Data Corporation (IDC) projects that AI-related spending on hardware, software, and services will surge from $232 billion in 2024 to over $500 billion by 2027, with annual growth averaging near 30%.

Investment Implication: Consider exposure to companies developing AI technologies, as well as those effectively implementing AI to enhance their products, services, and operations. This includes not just tech giants, but also firms in sectors like healthcare, finance, and manufacturing that are leveraging AI for competitive advantage.

The Semiconductor Surge

As the backbone of the digital economy, semiconductors are experiencing unprecedented demand. The rising prominence of AI is driving the need for ever-more sophisticated and complex chips, faster networking equipment, and increased data center capacity.

Investment Implication: Look at semiconductor manufacturers, especially those focused on advanced AI chips, as well as companies in the semiconductor equipment and design space. The industry's cyclical nature means timing is crucial, but the long-term trend is undeniably upward.

Cloud Computing and Data Centers

The shift to cloud-based services continues unabated. IDC projects that spending on cloud infrastructure will grow 12% annually over the next five years. This growth is driven by businesses leveraging the cloud's scalability, flexibility, and cost efficiencies.

Investment Implication: Consider investments in leading cloud service providers and companies that supply critical infrastructure for data centers. Also, look at cybersecurity firms, as the increasing reliance on cloud services heightens the need for robust security measures.

The Internet of Things (IoT) and Edge Computing

As more devices become connected, the IoT market is expanding rapidly. Coupled with this is the rise of edge computing, which brings data processing closer to the source of data generation. Gartner estimates that edge infrastructure is likely to double over the next five years.

Investment Implication: Look for companies developing IoT devices and sensors, as well as those providing edge computing solutions. Telecom companies rolling out 5G networks could also benefit from this trend.

Digital Transformation in Traditional Industries

The digital wave is not confined to the tech sector. Traditional industries are being reshaped by digital technologies. For instance, in the retail sector, eCommerce now accounts for about 20% of total sales in the U.S., up from single digits a decade ago.

Investment Implication: Identify companies in traditional sectors that are successfully navigating the digital transformation. These could include retailers with strong omnichannel strategies, industrial firms leveraging IoT and AI for improved efficiency, or financial institutions at the forefront of fintech adoption.

The Creator Economy and Digital Media

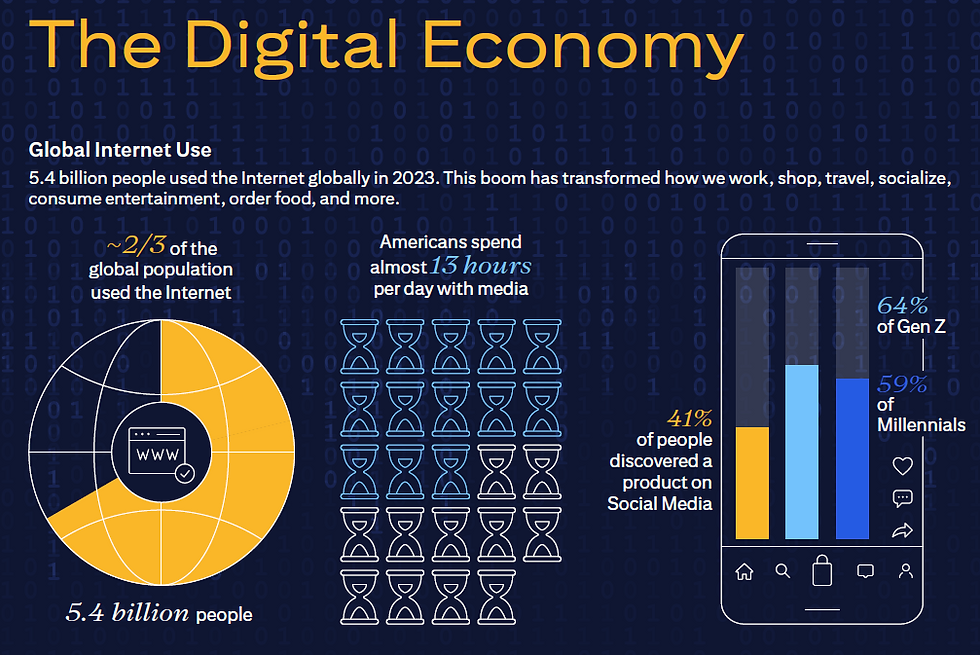

The rise of social media and digital platforms has given birth to the creator economy. With earnings estimated at nearly $75 billion last year, this sector is reshaping advertising, entertainment, and social media landscapes.

Investment Implication: Look at social media platforms, content creation tools, and companies that facilitate digital payments and monetization for creators. Also, consider streaming services and digital advertising platforms benefiting from the shift in media consumption habits.

Conclusion: Navigating the Digital Investment Landscape

While tech giants often dominate headlines, some of the most exciting opportunities may lie in companies that are effectively leveraging digital technologies to transform their traditional business models. Look for firms with strong digital strategies, robust data analytics capabilities, and a culture of innovation.

Remember, the digital transformation is not just about technology – it's about how technology is applied to solve problems and create value. As you construct your portfolio, consider how different companies and sectors are positioned to benefit from or potentially be disrupted by these digital trends.

Royce Advisory Pty Ltd (ABN 43 622 402 706) is a Corporate Authorised Representative (CAR) of MB Capital Partners Pty Ltd (AFSL 536053). This article, commentary and discussion is general information only and is not intended to provide you with financial advice as it does not consider your investment objectives, financial situation or particular needs. You should consider whether the information is suitable for your circumstances and where uncertain seek further professional advice.

This communication is based on information from sources believed to be reliable at the time of its preparation (August 2024). However, despite our best efforts, no guarantee can be given that all information is accurate, reliable and complete. Any opinions expressed in this email are subject to change without notice and neither Royce Advisory or MB Capital Partners is not under any obligation to notify you with changes or updates to these opinions. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information.

Comments