Australian Banks - Current Outlook on ANZ, WBC, CBA & NAB

- Royce Advisory

- Jul 2, 2024

- 3 min read

Investing in Australian banks have traditionally been a core pillar of stability, growth and income in client portfolios. The likes of Australian banks such as ANZ, Westpac (WBC), Commonwealth Bank of Australia (CBA), and National Australia Bank (NAB) do however currently face a set of unique challenges and opportunities that we are actively considering with out investors.

Interest Rate Fluctuations and Margins:

Changes in cash rate expectations present both risks and opportunities for bank margins. Higher interest rates can bolster margins but also increase the risk of credit defaults. For instance, recent assessments suggest that while higher rates could mitigate margin pressures, they also elevate the potential for higher bad debts due to a deeper credit cycle. It’s crucial to monitor the Reserve Bank of Australia's (RBA) policy changes closely, as these will significantly impact the profitability and credit risk profiles of banks.

Mortgage Credit Growth and Consumer Sentiment:

Despite robust housing credit growth, there are signs of a slowdown in certain regions, influenced by potential rate hikes. Mortgage brokers have indicated a dip in borrower sentiment, which could translate to slower credit growth. Investors should watch for changes in housing credit trends and consumer confidence as these factors directly affect bank revenues from mortgage lending.

Loan Impairments and Bank Valuations:

The market may need to reassess the currently low levels of loan impairment charges. Many banks have been operating with lower-than-expected impairment costs, which might not be sustainable if economic conditions worsen. Elevated bank valuations, trading at a premium to their historical averages, could be at risk if impairment charges rise. This reassessment could impact bank share prices and investor returns.

Business Lending Dynamics:

NAB has shown significant growth in business credit, whereas ANZ and CBA have varied performances. Understanding the dynamics of business lending and the sectors banks are most exposed to can provide insights into future growth prospects and risk areas. For instance, NAB's strategic focus on business lending has yielded higher growth rates, suggesting a potential for higher returns but also increased exposure to economic cycles.

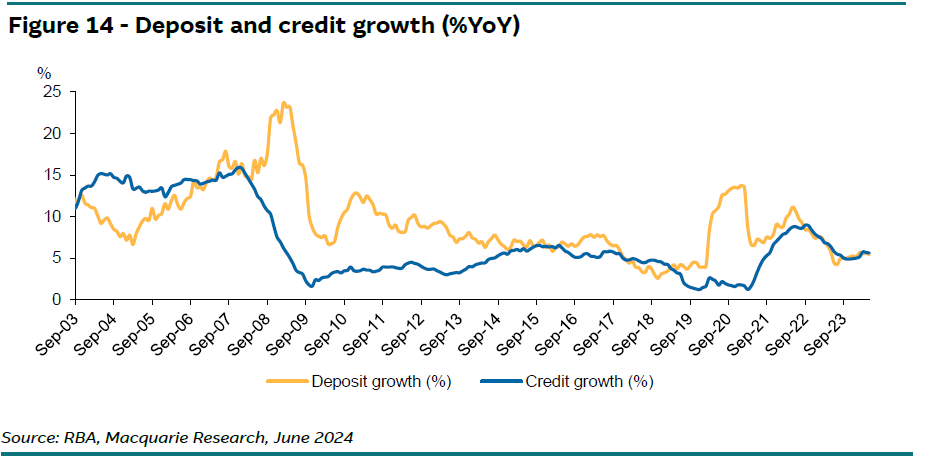

Deposit Trends and Funding Costs:

The composition and growth of deposits significantly impact banks' funding costs. Changes in household and business deposit growth can affect liquidity and the net stable funding ratio (NSFR). For example, recent data shows that while major banks have maintained healthy deposit growth, there are variations in their funding positions that could influence their lending capabilities and profitability.

Global Economic Conditions:

Australian banks are not insulated from global economic trends. Factors such as global inflation rates, geopolitical tensions, and international trade policies can affect the Australian economy and, consequently, the performance of Australian banks. Investors need to stay informed about global economic developments and their potential ripple effects on domestic financial institutions.

Conclusion

Investing in Australian banks requires a nuanced understanding of both domestic and global economic indicators. The interplay between interest rates, credit growth, loan impairments, business lending, deposit trends, and global economic conditions creates a complex environment that can offer substantial returns if navigated wisely.

DISCLAIMER

Royce Advisory Pty Ltd (ABN 43 622 402 706) is a Corporate Authorised Representative (CAR) of MB Capital Partners Pty Ltd (AFSL 536053). This article, commentary and discussion is general information only and is not intended to provide you with financial advice as it does not consider your investment objectives, financial situation or particular needs. You should consider whether the information is suitable for your circumstances and where uncertain seek further professional advice.

This communication is based on information from sources believed to be reliable at the time of its preparation (June 2024). However, despite our best efforts, no guarantee can be given that all information is accurate, reliable and complete. Any opinions expressed in this email are subject to change without notice and neither Royce Advisory or MB Capital Partners is not under any obligation to notify you with changes or updates to these opinions. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information.

Comments